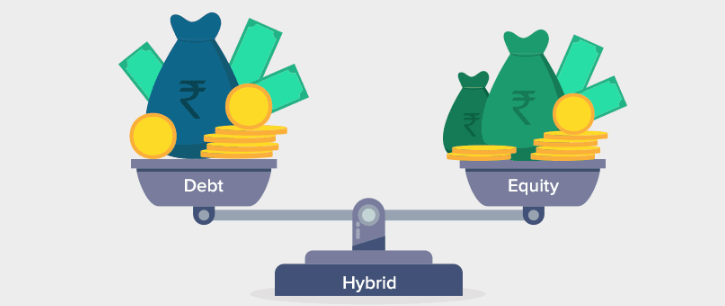

meaningful returns. Hybrid mutual funds have become one of the investment options worth considering. These funds invest in a mix of debt funds and equities, offering a diversified portfolio that aims to strike a balance between growth and stability. Let’s learn about features, benefits, and strategies for maximizing returns in hybrid funds.

Understanding Hybrid Mutual Funds

Hybrid mutual funds are investments that pool together various assets. Such types of investments merge stocks (equity) with bonds (debt), hence forming a diversified portfolio. Its main aim is to minimize the risk while boosting returns thus making hybrid funds a flexible choice for investors.

Why Choose Hybrid Mutual Funds?

- Risk Management:

Hybrid fund managers employ strategic asset allocation whereby they change the proportion of their holdings between equity and debt according to prevailing market conditions and risk tolerance.

- Growth Potential:

Debt funds guarantee stability and regular income but equity schemes allow higher returns. Therefore, hybrid schemes aim to take advantage of potential growth prospects in equities through the stabilizing influence of fixed-income funds leading to good risk-return trade-offs for investors.

- Simplified Investment Approach:

Hybrid funds offer a good option for investors who are looking to simplify their investment approach.

Feature of Investing in Hybrid Mutual Funds

Various unique characteristics come with investing in hybrid funds making them suitable for many investors.

- Balanced Risk and Reward

The hybrid mutual fund’s attempt is always to create a balance by having both equities and debt instruments. This offers the potential of high yields on equity while debts provide stability as well as income thus in the process reducing the overall risk

- Regular Income

Hybrid funds can be an appropriate option if an investor needs regular income. The debt side often produces interest that can be paid to the investors.

- Tax Efficiency

One may also enjoy tax advantages when using a hybrid fund depending on how it is invested between equity and debt. For some investments, their taxation may be preferable to others thereby improving overall investor return from such investments.

Benefits of Hybrid Funds

There are many benefits to be realized from investing in hybrid mutual funds offers various benefits. Here are some:

Reduced Volatility

With fewer changes in fund prices, hybrid funds will be less volatile as compared to pure equity funds since they combine the two asset types which are stocks and bonds.

Potential for Higher Returns

Despite being less risky than plain money market mutual funds, hybrid funds also have better chances of getting higher returns than investing only in fixed-income funds.

Diversified Portfolio

When you invest in hybrid mutual funds, there is an immediate diversification that takes place. Instead of putting all your money into one type of asset class, hybrid funds spread investments across different funds so that the performance of any single investment is not significantly detrimental.

How to Invest in Hybrid Mutual Funds

- Identify Your Investment Objectives.

Before investing, define your financial goals in precise terms. These goals will largely determine the kind of hybrid fund that suits your interest.

- Assess Your Risk Tolerance

It is important to know how much risk you can withstand. Moreover, different types of hybrid funds have different risks. So, it is important to choose the funds that meet your risk tolerance.

- Research And Choose Funds

Conduct extensive research to find hybrid funds that meet your criteria. Look at things such as the performance history of the fund, expense ratio, and reputation of its manager.

- Set Up An Account For Investing

To invest in hybrid mutual funds, you have to open an account. In this, you only have to fill out some details like name, phone number, PAN card details, and Aadhaar card details. However, it is important to add accurate details.

- Monitor Your Investments

Once invested; keep monitoring how well your hybrid funds perform regularly. Observe market trends and economic indicators that may have effects on your investment

Tips for Maximising Returns

A strategic approach and disciplined investment are vital to maximizing returns from hybrid mutual funds.

- Start Early and Invest Regularly

It is advisable to begin investing at an early stage and make regular contributions. The power of compounding is a good option that lets your investments grow over time.

- Stay Updated

You must stay informed about market trends and economic developments. You can optimize your returns by understanding the drivers behind the performance of your hybrid mutual funds as well as being able to make timely decisions.

- Rebalance Your Portfolio

Review your portfolio and rebalance it regularly, perhaps once in a year, depending on your financial objectives and how much risk you can afford. Rebalancing refers to the alteration of the proportion between debt and equity for purposes of accommodating changing market circumstances or personal developments.

Conclusion

Hybrid mutual funds are an investment option that is professionally managed and suitable for different kinds of investors. Talking about such characteristics as benefits and features, many individuals can easily decide how their savings might be turned into “earnings” or other profits from investing in Mixed type Mutual Funds. Hybrid funds are a necessary addition to a stock portfolio if you are looking for consistent income, capital gains, or risk sharing.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.