Rivian, an electric vehicle (EV) manufacturer, has garnered significant attention from investors since its initial public offering (IPO). With its commitment to sustainability and innovative vehicle lineup, Rivian is seen as a strong competitor in the EV market. This comprehensive guide will provide you with insights into Rivian stock, its performance, and what to consider before investing.

What is Rivian?

Rivian Automotive, Inc. is an American electric vehicle automaker founded in 2009 by RJ Scaringe. Rivian focuses on producing adventure-oriented electric trucks and SUVs. The company’s flagship models, the R1T pickup truck and the R1S SUV, are designed to offer exceptional performance and sustainability.

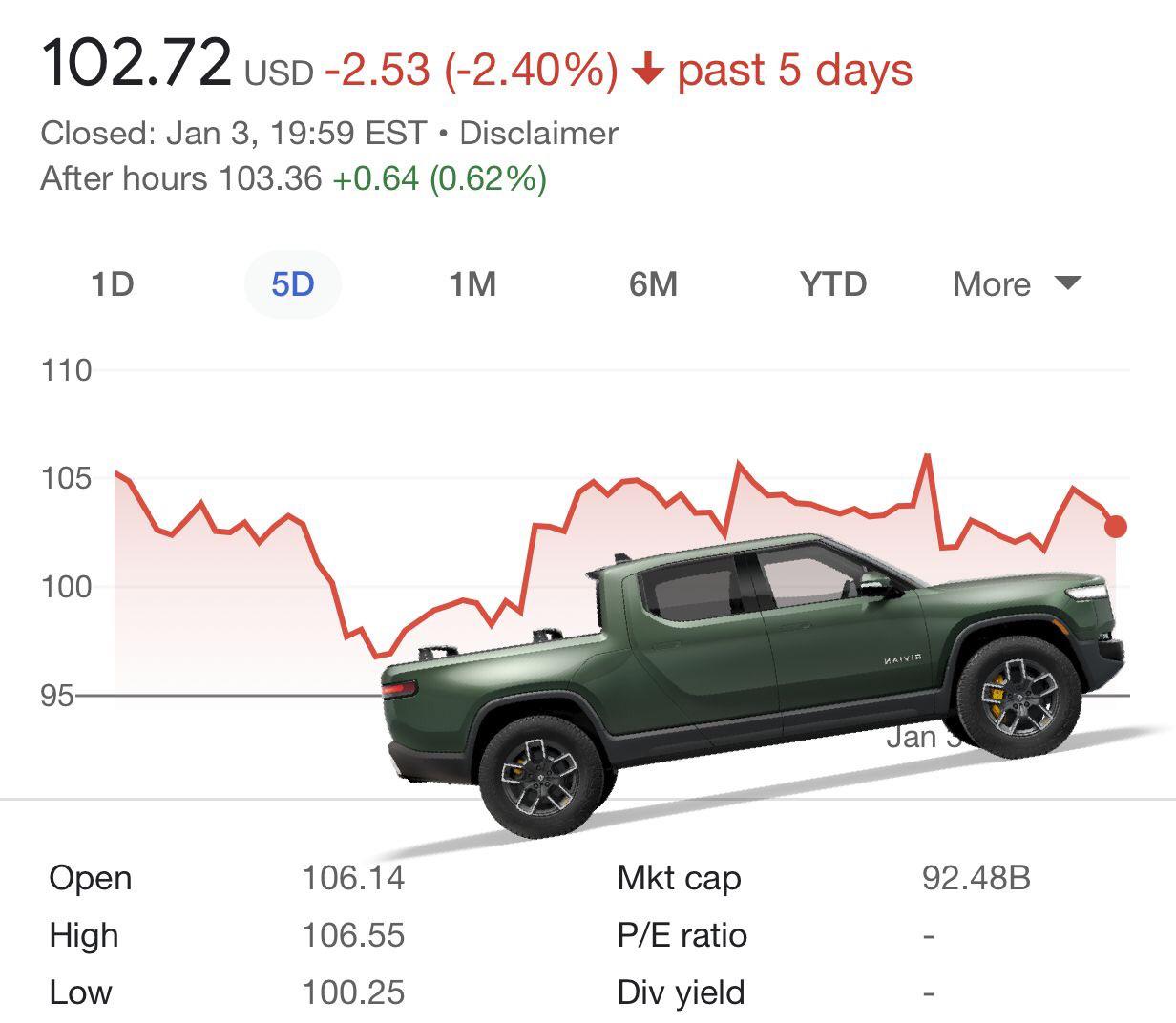

Rivian’s IPO and Stock Performance

Rivian went public on November 10, 2021, in one of the largest IPOs of the year, raising around $13.7 billion. The IPO was highly anticipated, given the growing interest in electric vehicles and Rivian’s potential to rival industry leaders like Tesla.

Initial Public Offering (IPO)

- Date: November 10, 2021

- Initial Price: $78 per share

- Market Valuation: Approximately $66.5 billion at IPO

Factors Influencing Rivian Stock

1. Product Line and Innovations

Rivian’s R1T and R1S models have received positive reviews for their innovative features, robust performance, and off-road capabilities. The company’s focus on developing electric delivery vans for Amazon also adds to its growth potential.

2. Partnerships and Collaborations

Rivian has formed significant partnerships, including a notable deal with Amazon to provide 100,000 electric delivery vans by 2030. Such collaborations can positively influence Rivian’s stock by expanding its market reach and revenue streams.

3. Market Demand for EVs

The global shift towards sustainability and clean energy has increased demand for electric vehicles. As more consumers and governments push for eco-friendly transportation options, Rivian stands to benefit, potentially driving up its stock value.

4. Financial Performance

Investors should closely monitor Rivian’s financial reports, including revenue growth, production numbers, and profitability. Being a relatively new public company, its financial health will play a crucial role in stock performance.

5. Competitive Landscape

The EV market is highly competitive, with major players like Tesla, Ford, and General Motors investing heavily in electric vehicle technology. Rivian’s ability to maintain a competitive edge will be crucial for its stock performance.

How to Buy Rivian Stock

1. Choose a Brokerage

Select a brokerage platform that offers access to the NASDAQ, where Rivian is listed. Popular options include:

- E*TRADE

- Charles Schwab

- Robinhood

- TD Ameritrade

2. Open an Account

If you don’t already have an account with a brokerage, you will need to open one. This typically involves providing personal information and linking a bank account.

3. Deposit Funds

Transfer funds from your bank account to your brokerage account to prepare for purchasing Rivian stock.

4. Search for Rivian Stock

On your brokerage platform, search for Rivian by its ticker symbol: RIVN.

5. Place an Order

Decide how many shares you want to purchase and place an order. You can choose between a market order, which buys shares at the current market price, or a limit order, which buys shares at a specific price you set.

Risks and Considerations

1. Market Volatility

The stock market, particularly the EV sector, can be highly volatile. Prices can fluctuate significantly based on market trends, news, and investor sentiment.

2. Regulatory Changes

Changes in government policies and regulations regarding electric vehicles and environmental standards can impact Rivian’s operations and stock price.

3. Production Challenges

As a growing company, Rivian may face production and supply chain challenges that could affect its ability to meet delivery targets and financial goals.

4. Competition

The increasing competition in the EV market from established automakers and new entrants could pose challenges to Rivian’s market share and profitability.

Conclusion

Investing in Rivian stock offers the potential for significant returns, given the company’s innovative approach to electric vehicles and strong market position. However, it’s essential to consider the associated risks and conduct thorough research before making an investment decision. By staying informed about Rivian’s performance, market trends, and industry developments, investors can make more informed choices about including Rivian stock in their portfolios.